You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Gold at $25000. Silver at $600.

- Thread starter Declan

- Start date

More options

Who Replied?- Joined

- Sep 3, 2022

- Messages

- 3,630

- Reaction score

- 4,977

Worth a read.

substack.com

substack.com

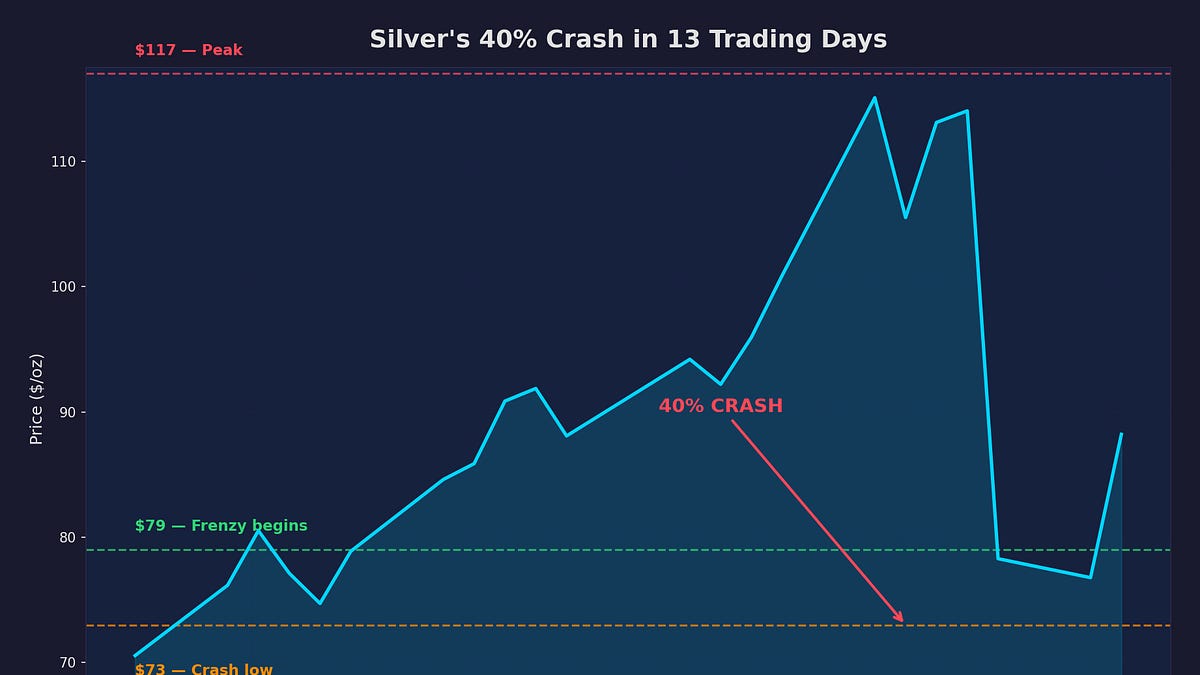

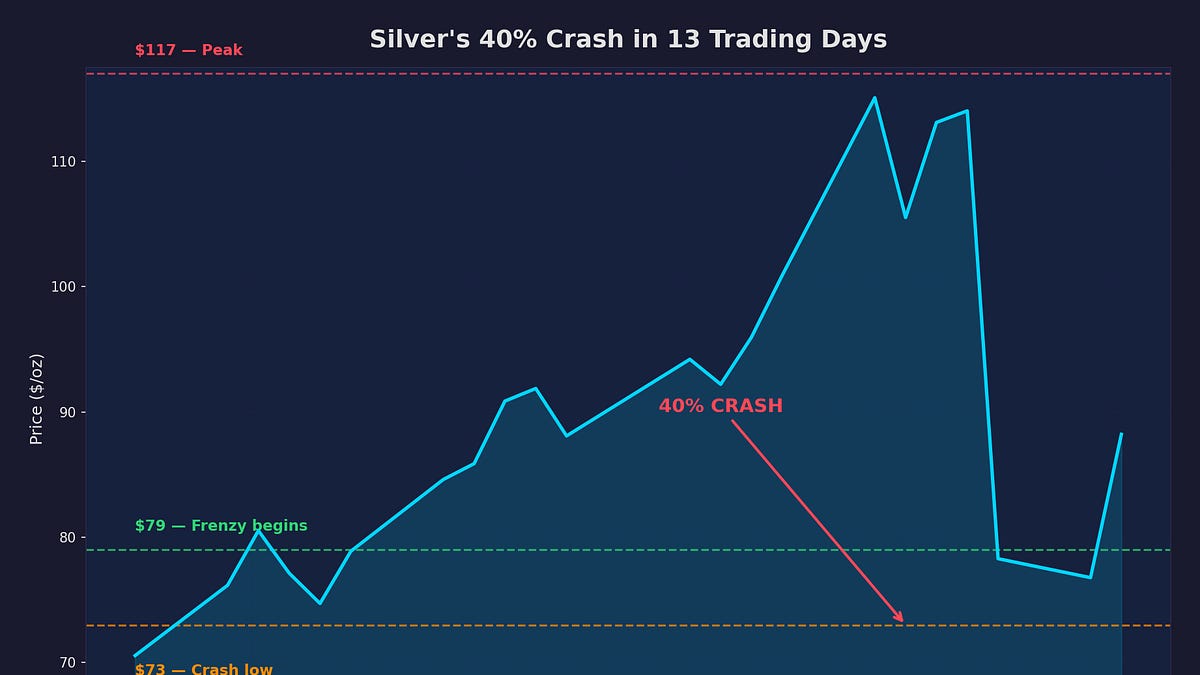

Silver's 40% Crash Was the Most Predictable Disaster of 2026

The precious metals frenzy that wasn't about the dollar at all — and the Chinese fraud story that proves it

Latest Threads

-

Is this whole Jeffrey Epstein thing a psyop ?

- Started by Jay Homer Simpson

- Replies: 12

-

The SSPX are going to consecrate new bishops

- Started by scolairebocht

- Replies: 4

-

Is Democracy itself the problem, or can it be rescued?

- Started by scolairebocht

- Replies: 14

-

-

Popular Threads

-

-

-

-

-

C

-