You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Gold at $25000. Silver at $600.

- Thread starter Declan

- Start date

More options

Who Replied?- Joined

- Jan 11, 2023

- Messages

- 4,205

- Reaction score

- 3,958

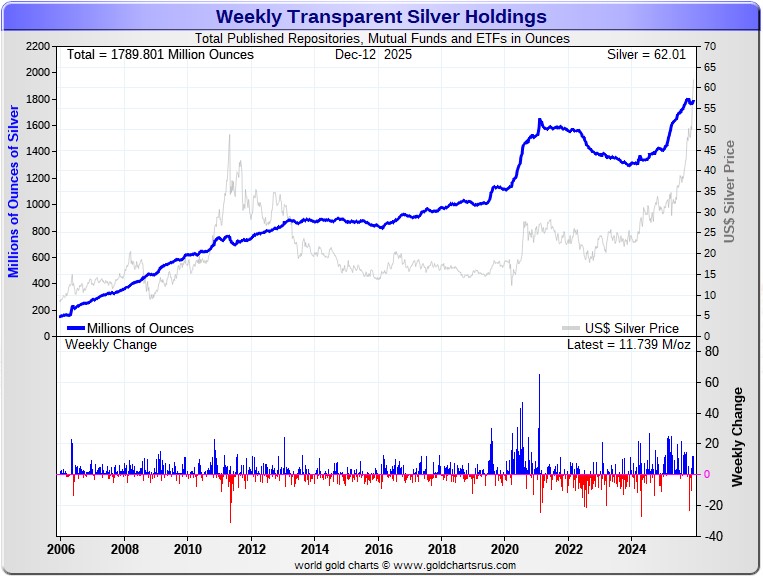

That remains the problem. Over 900 million paper contracts dumped today so far. Apparently these have been rolled into the March contracts, kicking the can down the road and putting off the official short squeeze till 2026. But this is a problem with no solution for the shorts. That game has been badly exposed.Where is the metal for the paper?

That seems to be the problem.

- Joined

- Jan 11, 2023

- Messages

- 4,205

- Reaction score

- 3,958

- Joined

- Jan 11, 2023

- Messages

- 4,205

- Reaction score

- 3,958

- Joined

- Jan 11, 2023

- Messages

- 4,205

- Reaction score

- 3,958

Despite the fact that silver has now broken the $64 barrier -- and the silver well in London is running close to empty...with very elevated lease rates...the gold/silver ratio remains at a farcical 69.5 to 1 as of the Friday's close. The 'normal' and historical ratio is around 15 to 1...which would put silver at about $286. And if priced at the ratio of 7:1 that it comes out of the ground at, compared to gold...that would put silver at around $614 an ounce. So a triple-digit silver price is in our future -- and all that remains to be resolved is what that number will be -- and how soon 'da boyz' allow it to happen.

A Massive and Premeditated Bear Raid

Despite the fact that silver has now broken the $64 barrier -- and the silver well in London is running close to empty...with very elevated lease rates...the gold/silver ratio remains at a farcical 69.5 to 1 as of the Friday's close. The 'normal' and historical ratio is around 15 to 1...which...

- Joined

- Feb 14, 2023

- Messages

- 6,353

- Reaction score

- 5,762

What occurred ? !Bad news for Bank of America

- Joined

- Sep 3, 2022

- Messages

- 3,679

- Reaction score

- 5,015

Speak site owner!Bad news for Bank of America

What's happened?

- Joined

- Sep 11, 2021

- Messages

- 9,828

- Reaction score

- 6,957

I read the long article posted bt @PlunkettsGhost and learned B of A is short, JBM are long.

It said there are 7 other big shorts but did not name them and might be overseas

It said there are 7 other big shorts but did not name them and might be overseas

- Joined

- Sep 3, 2022

- Messages

- 3,679

- Reaction score

- 5,015

Woops.I read the long article posted bt @PlunkettsGhost and learned B of A is short, JBM are long.

It said there are 7 other big shorts but did not name them and might be overseas

And they sre short big time I'd guess

- Joined

- Sep 3, 2022

- Messages

- 3,679

- Reaction score

- 5,015

400 million shortfall .per annum. I stand to be corrected.One billion ounces according to the article.

Annual production I think is a little less than a billion ounces!!!!!

- Joined

- Jan 11, 2023

- Messages

- 4,205

- Reaction score

- 3,958

- Joined

- Jan 11, 2023

- Messages

- 4,205

- Reaction score

- 3,958

- Joined

- Sep 11, 2021

- Messages

- 9,828

- Reaction score

- 6,957

View: https://youtu.be/4YjsyoBEsLU?si=9DGiayPHkTR5p09Z

According to this lad, there is very little short now.

We shall see how it opens at 6 pm tomorrow my time.

I expect fireworks especially tuesday when the delayed employment report for november is released

- Joined

- Jan 11, 2023

- Messages

- 4,205

- Reaction score

- 3,958

The “line ups” are not in futures.They’re in PHYSICAL silver.This move is driven by inelastic global physical demand, not paper speculation.Margin hikes can cool leverage.They can’t create silver that doesn’t exist.That’s why this rally is different.Not a paper spike.A structural repricing.

View: https://x.com/honzacern1/status/2000279945596023126

- Joined

- Jan 11, 2023

- Messages

- 4,205

- Reaction score

- 3,958

- Joined

- Sep 3, 2022

- Messages

- 3,679

- Reaction score

- 5,015

400 million ounces shortfall per annum.

That cannot be papered over.

The market has been rigged since the Hunt brothers tried to corner the market for silver in 1980.

As it stands the jump in prices will play hell with the electronics, pv and ev industries.

There's a genuine revision of the price of silver occurring.

Back in 2010 the price tipped $42 briefly.

Due to the shaking economic situation.

If silver prices were linked to inflation only from this point its about $62.

Adjusted for its 1980 high it needs to hit 170 dollars.

Last edited:

- Joined

- Jan 11, 2023

- Messages

- 4,205

- Reaction score

- 3,958

Asia up nicely this morning. Margin rate hikes don't seem to have impacted the trend much:

View: https://x.com/davidbateman/status/2000288857569595756?s=20&fbclid=IwY2xjawOszBFleHRuA2FlbQIxMABicmlkETFDcU5FRnltemhNWGl0QWczc3J0YwZhcHBfaWQQMjIyMDM5MTc4ODIwMDg5MgABHvkNKLL_C_bJ4qg-paO7N5LCWGsHCUfju2b79hIcKgg4p79F4ihSpfmm9QLL_aem_1ELcqyg5_qMWHOs97LFBbQ&brid=uGvdrnmoZ5mYjO0pQU7nTg

View: https://x.com/davidbateman/status/2000288857569595756?s=20&fbclid=IwY2xjawOszBFleHRuA2FlbQIxMABicmlkETFDcU5FRnltemhNWGl0QWczc3J0YwZhcHBfaWQQMjIyMDM5MTc4ODIwMDg5MgABHvkNKLL_C_bJ4qg-paO7N5LCWGsHCUfju2b79hIcKgg4p79F4ihSpfmm9QLL_aem_1ELcqyg5_qMWHOs97LFBbQ&brid=uGvdrnmoZ5mYjO0pQU7nTg

- Joined

- Jan 11, 2023

- Messages

- 4,205

- Reaction score

- 3,958

- Joined

- Jan 11, 2023

- Messages

- 4,205

- Reaction score

- 3,958

- Joined

- Jan 11, 2023

- Messages

- 4,205

- Reaction score

- 3,958

- Joined

- Jan 11, 2023

- Messages

- 4,205

- Reaction score

- 3,958

I'll take it. Things were looking sideways all day after the initial gap up

- Joined

- Jan 11, 2023

- Messages

- 4,205

- Reaction score

- 3,958

- Joined

- Sep 3, 2022

- Messages

- 3,679

- Reaction score

- 5,015

Is the xrp bubble bust?

- Joined

- Feb 14, 2023

- Messages

- 6,353

- Reaction score

- 5,762

- Joined

- Jan 11, 2023

- Messages

- 4,205

- Reaction score

- 3,958

Probably. I had a small punt on it.Is the xrp bubble bust?

- Joined

- Jan 11, 2023

- Messages

- 4,205

- Reaction score

- 3,958

Silver on tear in Asian trading rn

- Joined

- Jan 11, 2023

- Messages

- 4,205

- Reaction score

- 3,958

- Joined

- Jan 11, 2023

- Messages

- 4,205

- Reaction score

- 3,958

- Joined

- Jan 11, 2023

- Messages

- 4,205

- Reaction score

- 3,958

- Joined

- Jan 11, 2023

- Messages

- 4,205

- Reaction score

- 3,958

Latest Threads

-

-

-

-

-

Is this whole Jeffrey Epstein thing a psyop ?

- Started by Jay Homer Simpson

- Replies: 16

Popular Threads

-

-

-

-

-

C

-