- Joined

- Jan 11, 2023

- Messages

- 4,182

- Reaction score

- 3,932

I'll be paying off the mortgage at 600, and then some.

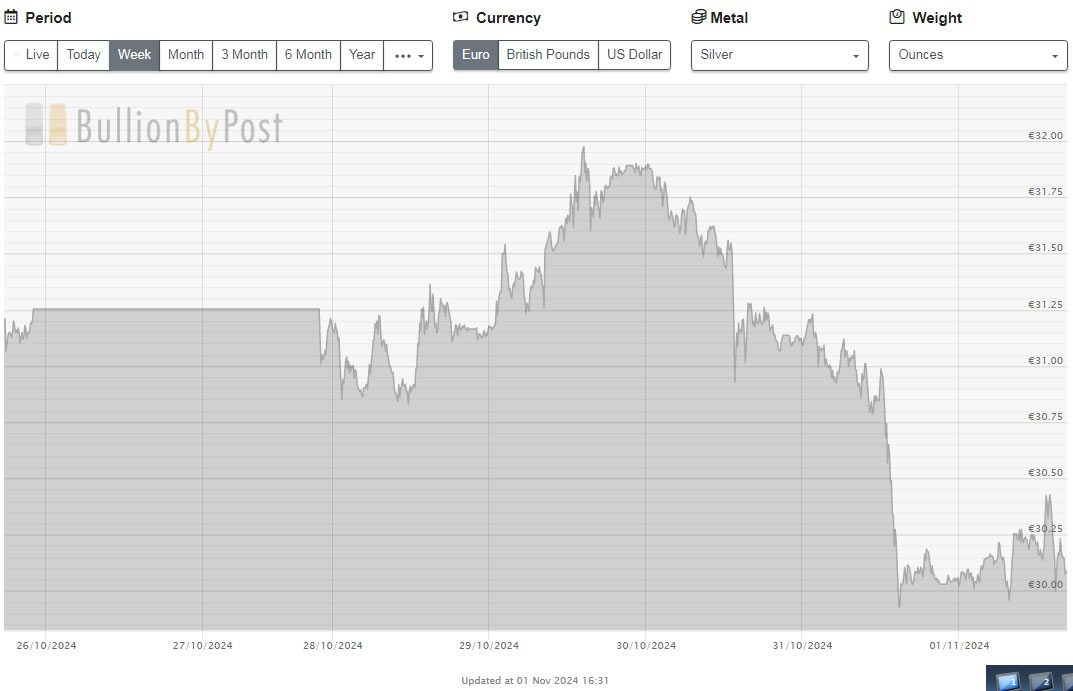

I'd settle for 200. I am very black pilled on silver tho, due to its industrial application. I can see the powers keeping it low, for that reason. I'd consider selling a chunk at 50 at this point.

I'd settle for 200. I am very black pilled on silver tho, due to its industrial application. I can see the powers keeping it low, for that reason. I'd consider selling a chunk at 50 at this point.